Updated July 23, 2022 449 Author: Dmitry Petrov

Hello, dear readers of the KtoNaNovenkogo.ru blog. New words and terms are actively penetrating into our vocabulary, which, due to their novelty and borrowing from other languages, do not always seem understandable.

For example, today we will look at the word reorganization, which some associate with oral hygiene, and for others with problems with the bank where their money is.

This term is truly diverse, but today we will talk more about banks and their rescue from bankruptcy, as well as whether depositors should rejoice if they decide to reorganize their bank.

What is rehabilitation?

Rehabilitation usually refers to a set of measures aimed at restoring the solvency of a bank and improving its financial condition. The main goal of reorganization is to increase the efficiency of the credit institution and restore its competitiveness in the market, which is a prerequisite for avoiding bankruptcy. One of the main provisions of the Federal Law of the Russian Federation No. 40-FZ “On the insolvency of credit organizations” is the recognition of the legal equality of several procedures, in particular, reorganization, the appointment of a temporary manager as the first stage of bankruptcy and reorganization.

One of the conditions for bank reorganization is the identification of an investor for its implementation. Its tasks include not only carrying out activities aimed at increasing the efficiency of the bank, but also, most importantly, allocating additional financial resources. As practice has shown, not all banks that were appointed as investors, that is, sanators, to carry out measures to improve problem credit institutions in 2013-2014, coped with the task. Moreover, at least two of them - the already mentioned Bank Otkritie and Binbank - today themselves are in need of reorganization by the Central Bank.

Concept

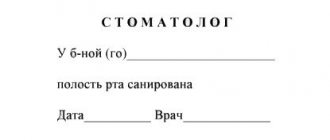

Even healthy teeth require constant care to maintain their natural beauty. Age-related changes, previous illnesses or irregular hygiene procedures complicate the dentist’s work. This situation is typical for most people, and the possibilities of aesthetic medicine make it possible to eliminate a huge part of such shortcomings. Incorrect positioning of teeth, their damage or absence can be corrected by sanitation of the oral cavity. The implementation and order of the necessary procedures are determined individually and may require several visits to the dentist.

Sanitation of the oral cavity

– is a set of measures aimed at correcting all defects of the oral cavity. Treatment of gums and teeth, dental orthopedics and prosthetics are the most important areas in such recovery. After completing all the necessary procedures, the patient receives completely healthy teeth and an aesthetically perfect dentition. Oral sanitation is not a one-time procedure and is carried out throughout life. This approach will provide an opportunity to prevent the development of dental diseases, which will have a positive impact on health and the cost of dental services.

Signs of a problematic bank situation

Article 4 of the above-mentioned No. 40-FZ provides a clear description of the grounds sufficient to prescribe a reorganization procedure. These include:

- failure to comply with creditors' demands for payment of obligations during the last 6 months;

- impossibility of making a payment within 3 days due to the lack of funds in the bank’s correspondent accounts;

- non-compliance with the standards established by the Central Bank in relation to current liquidity by more than 10% per month, as well as in terms of solvency indicators and the minimum capital of a credit institution;

- a reduction in the amount of capital by 20% or more compared to the maximum amount of this parameter for the previous year;

- reduction of the bank's capital for the reporting period to a level that is lower than established by the constituent documents of the organization (for banks operating on the market for more than 3 years).

If any of the above factors are identified, the bank management is obliged to begin reorganization. In addition, the relevant information must be communicated to the market regulator, that is, the Central Bank of Russia. If these violations were identified directly by Central Bank specialists during the implementation of control functions, the bank is either issued an order to eliminate them, or a forced reorganization procedure is introduced. Until recently, two options were used to carry it out:

- using funds from the DIA, that is, the Deposit Insurance Agency;

- by appointing as a sanator another bank that has funds sufficient to rehabilitate a problem credit institution.

However, in July 2022, the Central Bank of the Russian Federation announced the launch of a third possible rehabilitation scheme using funds from the newly created Consolidation Fund, the main role in which will be played by representatives of the Central Bank itself. This is exactly the scheme that is currently being used to rehabilitate B&N Bank and Otkritie Bank.

Indications

The development of pathological microflora and a high risk of infection entering the cervical canal and uterus are the main indications for antibacterial treatment of the external genitalia. This procedure is prescribed when diagnosing the following bacterial, viral and fungal infections of the reproductive organs in the fairer sex:

- bacterial vulvovaginitis;

- gardnerellosis;

- candidiasis;

- colpitis;

- mycoplasmosis, ureaplasmosis, chlamydia;

- papillomavirus infection.

Sanitation is also performed as part of complex therapy in the treatment of gynecological inflammatory diseases of the pelvic organs - endo- and myometritis, oophoritis, salpingitis, adnexitis, pelvioperitonitis, etc.

For preventive purposes and to avoid the development of subsequent inflammation, antiseptic treatment must be carried out before minimally invasive studies related to penetration into the uterine cavity:

- hysteroscopy;

- colposcopy;

- diathermocoagulation of cervical erosion;

- oncocytology;

- biopsy;

- diagnostic curettage of the uterine cavity mucosa;

- conization of the cervix and others.

Vaginal sanitation is indicated in gynecological surgery:

- before planned surgical treatment of pathologies of the genitourinary system, both during abdominal and minimally invasive interventions;

- artificial termination of pregnancy;

- installation of an intrauterine device, since the procedure can reduce the number of purulent complications and infections.

For medical reasons, pregnant women will have to undergo vaginal sanitation in order to prevent infection of the child during labor. This manipulation is prescribed when urogenital infections are detected in pregnant women.

Reasons for reorganization

In addition to the criteria described above related to the financial condition of the bank, two significant factors may serve as the basis for making a decision on resolution:

- serious importance of the bank in the financial sector of the country. This means that the bankruptcy of a credit institution can cause significant harm to the Russian banking system, which can lead to problems in other banks;

- The bank's difficulties are temporary and unsystematic in nature and can easily be eliminated with a reasonable level of investment on the part of the owners of the credit institution or sanatorium.

In most cases, reorganization is applied to those financial structures that have been operating on the market for quite a long time and have an established reputation and status. If we are talking about a newly opened or small bank, most often the Central Bank of Russia simply revokes its license, thus stopping its activities.

Advantages over bankruptcy

Bankruptcy is an extreme and undesirable measure. Especially if we are talking about systemically important banks. Their elimination can lead to global problems, for example:

- the bankruptcy of other financial institutions that held their capital in deposits or bonds of a larger bank;

- loss of money by the Central Bank, which issued short-term loans to financial institutions secured by securities of a systemically important bank;

- undermining public confidence in the domestic banking system, which will cause a massive outflow of clients;

- withdrawal of money from deposits and investing it in other assets (primarily foreign currency), which will lead to devaluation of the national currency;

- a fall in stock prices of financial companies and, against this background, a decline in the stock market.

Successful resolution has a number of advantages over bankruptcy:

- Maintaining public and business confidence in the banking system.

- Avoiding the outflow of money from accounts and maintaining stability in the banking system.

- Stabilization of the financial position of the troubled bank and everyone associated with it.

Who benefits from this?

Successful bank resolution benefits absolutely all participants in the process. The credit institution begins to operate effectively as normal again. The sanator gets the opportunity to return the investment with a profit. Clients of the bank being rehabilitated retain funds in their accounts, and in full, and not in accordance with the limit established by the DIA. The interest and benefit of the country's Central Bank is also quite obvious - the state's financial system is becoming more stable. Even the competitors of a struggling bank benefit from successful reorganization, as it maintains customer confidence in the entire banking system of the country.

The only problem is that not every sanitation procedure initiated is completed successfully. In this case, the exact opposite picture described above is observed. The sanatorium loses its invested funds, and, as the examples of B&N Bank and Otkritie Bank clearly showed, it can itself find itself in a difficult financial situation. The owners of the bank being rehabilitated will lose their own business, since the Central Bank of the Russian Federation will most likely revoke the license as a result. Some of the bank's clients lose funds; only the owners of deposits are guaranteed to return them from the accounts of the Deposit Insurance Agency, the amount of which, together with accrued interest, does not exceed 1.4 million rubles.

Who carries out recovery and how?

Financial recovery is carried out by the owner of the organization independently, with the participation of the Bank of Russia or the Deposit Insurance Agency (DIA). Main measures taken:

- Financial assistance from founders, participants and other persons. It must be sufficient to pay off monetary obligations, pay obligatory payments and restore the solvency of the organization.

- Changing the structure of assets and liabilities.

- Changing the organizational structure of the company.

- Bringing the size of the authorized capital and equity capital to the standards.

A complete list of banks undergoing rehabilitation with the participation of the Bank of Russia and the DIA, as well as those organizations for which the rehabilitation procedure has been completed, is available on the website of the Central Bank of the Russian Federation.

Who will be saved

In what cases can the Central Bank or the DIA take part in the financial recovery of a credit organization:

- It is significant for the economy of a country, a particular region or industry. Plays a significant role in the country's financial system, and its bankruptcy will lead to serious negative consequences.

- She did not violate the law, but the problems resulted from, for example, an incorrect assessment of risks, miscalculations in credit policy, and the influence of external factors.

- The reorganization will have a positive economic effect. There is no point in saving something that can no longer work effectively. Financial recovery is a very expensive undertaking. If the amount of assistance exceeds the amount that the DIA will pay to depositors in the event of bankruptcy and revocation of the license, then there is practically no chance of salvation.

For example, there is a well-known story with FC Otkritie, the largest private bank in the country. At the time of the problems in 2022, it had opened deposits worth 540 billion rubles, it participated in the reorganization of Rosgosstrakh, Trust Bank and NPF Lukoil-Garant. And besides this, he also serviced his bond issues.

If FC Otkrytie went bankrupt and defaulted on its obligations, then smaller companies would also go bankrupt. The fact is that they owned problem bonds and transferred them as collateral to the Central Bank of the Russian Federation to obtain short-term loans. Plus, the financial capabilities of the DIA are not unlimited and the agency was not able to reimburse half a trillion rubles to depositors. In this situation, not a single banking system could withstand the bankruptcy of Otkritie Financial Corporation.

The Bank of Russia annually approves a list of systemically important banks. Tinkoff Bank recently got into it. And today the list includes 13 participants. By the way, the Discovery is also systemically significant.

Participation of the Bank of Russia

Since 2022, a new mechanism for the financial recovery of credit institutions has been launched in Russia. Its main participant is the Bank of Russia. Through the Banking Sector Consolidation Fund he created, he directs funds to:

- purchase of shares or shares in a problem organization;

- providing loans, placing deposits, providing guarantees;

- acquisition of property of rehabilitated banks;

- providing financial assistance to banks being rehabilitated and investors who participate in the reorganization.

Based on the results of the recovery, the shares (shares) and property of the problem financial organization can be put up for open auction for sale to new owners.

Participation of the Deposit Insurance Agency

The participation mechanism of the Deposit Insurance Agency is called credit. Applied since 2008 and includes a set of measures, including:

- attracting an investor (another bank or not a credit organization at all), which buys out a controlling stake (share in capital);

- financial assistance in the form of loans at a rate below the market rate, in this case the bank provides loans to its clients at a higher rate, and using the resulting difference tries to solve financial problems.

On the DIA website you can see a complete list of banks in relation to which the Agency applied financial recovery measures. There are 3 stages:

- The recovery procedure has been introduced.

- The recovery is complete.

- Transfer of property and obligations (bankruptcy proceedings and revocation of license).

For some organizations, reorganization continues for several years. For example, in CB Solidarnost - since 2013, BM-Bank - since 2011. As of December 1, 2021, the Agency takes part in the financial recovery of 13 banks by attracting investors. Property and liabilities for 4 of them (JSCB Elektronika, CB Moskovsky Capital, JSCB MZB and My Bank. Mortgage) were transferred to other credit organizations.

Ways to improve your health

The reorganization procedure provides for two main areas of work carried out by the Central Bank of the Russian Federation, the DIA or the sanator appointed by them:

- allocation of additional financial resources;

- selection of financial stabilization methods and their implementation.

Funding for economic recovery activities can occur in a variety of ways. Until recently, the most frequently used options were:

- use of funds from bank owners. The most calm and effective solution to the problem;

- provision of direct financial assistance from the DIA or Central Bank of the organization being reorganized;

- use of funds from a sanatorium designated for the treatment procedure;

- provision of funds from the DIA or Central Bank directly to the sanatorium.

Quite often, during the recovery procedure, all of the listed methods of providing financial assistance are used. However, until recently, it was not allowed to completely reorganize at the expense of the budget and the DIA. At the same time, the procedure introduced at Otkritie Bank and Binbank, which provides for the use of funds from the Consolidation Fund, may become the first example of how reorganization will be carried out, in fact, entirely at the expense of the budget. In this case, it does not matter at all whether this will be done through the reorganization of a credit institution or by entering into the capital of the bank being rehabilitated by purchasing its shares.

Carrying out activities during the reorganization of enterprises

Activities during the reorganization of an enterprise include financial, economic, production, technical, organizational and legal actions aimed at achieving or restoring the solvency, profitability and competitiveness of the debtor company for the long term. When carrying out reorganization, the main ones are considered to be measures of a financial and economic nature.

Financial and economic events reflect the features of financial relations that arise in the process of mobilization and use of internal and external sources of enterprise reorganization. These may be funds received under the condition of a loan (refundable or non-refundable).

Financial rehabilitation of enterprises most often includes several stages, with the main goal being:

- Covering current losses and eliminating (eliminating) their causes.

- Restoring or maintaining the liquidity and solvency of the company.

- Reducing all types of debt.

- Improving the working capital structure.

- Formation of funds of financial resources necessary for carrying out production, technical and organizational activities.

Reorganization of an organizational or legal nature frees the enterprise from unproductive production structures and improves:

- organizational structure of the enterprise;

- organizational and legal form of doing business;

- quality of management;

- relations between members of the work team.

Problem solving methods

The second area of work during bank reorganization is the determination of the main methods for increasing the competitiveness of a credit institution in the market and the efficiency of its work. A variety of measures can be used for this, the most famous of which are:

- restructuring of the bank's accounts payable. Most clients understand perfectly well that it is much more profitable to wait a little to submit claims if there is at least a small chance of restoring the bank’s functionality. When declaring bankruptcy, the likelihood of getting your money back is noticeably lower;

- sale of illiquid assets on the bank’s balance sheet;

- optimization and reorganization of the bank's management and management system. The previous system has proven to be ineffective, so it should be replaced with a more efficient one;

- staff reduction, closure of unprofitable branches and branches. In modern conditions, when an increasing number of clients prefer remote working methods, there is no need to maintain a large number of offices;

- introduction of modern working methods, including using the Internet, and optimization of costs at all levels.

Is it good or bad

For the credit institution itself, reorganization brings only advantages. Practice shows that after financial recovery, banks significantly change the direction of their activities, while simultaneously increasing capital turnover.

At the same time, the structure of the bank may also undergo changes. Among the most striking examples: the Bank of Moscow, which was subject to reorganization, subsequently became part of the VTB group. The result is the emergence of a completely new bank called VTB Bank of Moscow.

In this case, VTB acted as an investor, investing money in the financial rehabilitation of the Bank of Moscow. The merger of the two organizations served as a kind of dividend that was due to the investor.

Nuances of bank management during reorganization

The only option in which the management of the bank remains in the hands of its owners and the managers appointed by them is the case when the reorganization occurs on the initiative of the credit institution itself. If the decision to introduce a financial recovery procedure is made by the Central Bank of the Russian Federation, it is he who appoints a temporary administration to manage the bank. It usually consists of representatives of the Bank of Russia itself, the DIA and an organization appointed by the sanatorium. It is important to note that the temporary manager has the right to challenge and cancel even those financial transactions that were concluded before his appointment.

Why don't all banks rehabilitate?

Sanitation is a complex procedure. Its implementation requires time, finances, and the involvement of highly qualified experts. Therefore, not all banks undergo rehabilitation. To do this, you must meet the following requirements:

- Systemic significance of the problematic institution. If a bank is important for the financial market of an entire country or region, and its collapse could lead to a loss of confidence in banks as a whole on the part of customers, the likelihood of resolution is high. The chances increase when government funds or funds from large companies and foundations are placed in its accounts.

- Compliance with legal requirements. Recovery is likely if the bank conducted honest activities in relation to the regulator and clients and acted as a financial intermediary between investors and borrowers.

- Availability of economic justification. Before starting the procedure, the Bank of Russia assesses the upcoming costs. If the financial institution is not significant or cannot be rehabilitated, resolution is neither practical nor likely. In this case, bankruptcy proceedings begin, which is accompanied by revocation of the license.

ATTENTION!

Resolution is not only aimed at saving one specific financial institution. Its main direction is to maintain the stability of the entire banking system. Each case is considered individually. The regulator preliminarily assesses the possible consequences for clients and the entire market. If he believes that the reorganization does not have good grounds, revocation of the license is inevitable.

Features of reorganization in Russia

The Russian banking sector is characterized by a fairly large number of attempts to reorganize even not the largest and most significant credit institutions in the country. Naturally, there is a clear connection between the number of banks being rehabilitated and the current financial situation in the country. For example, during the 2008-2009 crisis, the Central Bank decided to introduce a financial recovery procedure in 14 credit institutions. During the relatively stable financial period from 2010 to 2013, the reorganization of only 2 banks was announced.

After the introduction of sanctions against Russia and a serious deterioration in the economic situation in the country in 2014 and 2015, the financial recovery procedure was prescribed in 12 and 15 credit institutions, respectively. In 2016, the situation as a whole did not change, and in the third quarter of 2017, two banks included in the top 15 largest financial organizations in the country, namely Otkritie Bank and B&N Bank, came under reorganization. This was largely a consequence of the main domestic feature of the financial recovery procedure, which consists in a relatively small percentage of successfully completed reorganizations.

Medication classification

The algorithm for carrying out the procedure remains identical at home and in the inpatient department of the hospital. For the first time, a doctor can show you how to do everything according to the instructions. Then the woman will be able to repeat everything at home without outside help.

The most important thing at this stage is to use only the products recommended by your treating specialists, without changing the procedure, dosage or number of times. A good medicine that is designed to help in a short time must have a number of qualities that enhance its effectiveness:

- performance;

- antifungal work;

- antimicrobial protection;

- antiviral protection.

The medication will have a pronounced effect against protozoa. But at the same time, the increased activity of the drugs should not be stopped by purulent or bloody discharge, if it comes to that.

Schematically, all antiseptics can be divided into three broad camps: narrow therapeutic focus, multicomponent formulations, and agents with a nonspecific spectrum of action.

All of them are suitable for different clinical cases, sometimes requiring combination with other drugs. The first category is considered gentle and effective at the same time. But you can use medications from there only after tests have been carried out with clearly defined results. Only with their help will it be possible not to miss the diagnosis.

But since it is often difficult to quickly identify a specific lesion, doctors prefer to play it safe by prescribing a remedy with a strong active ingredient. But such productivity will have to be paid for by inhibiting the development of lactobacilli.

Nonspecific drugs are often confused with narrow-profile representatives of the pharmacological market, but these are two different categories.

Nonspecific analogues work selectively, protecting other organs from their effects. But even here everything is not too rosy, because they often provoke an allergic reaction.

Today, pharmacists have moved forward, offering new solutions almost every year that make it possible to work on destroying the original source of the gynecological problem during sanitation really quickly.

At the same time, new generation liquids, which are used according to the scheme, are able to act against several types of microorganisms at once. And lactobacilli will remain fine. Suppositories based on solutions later began to appear, which are much easier to administer independently, using tampons as a template.

Powers of regulatory authorities

The main functions of control over the activities of banks are assigned to the Central Bank of the Russian Federation, which can make decisions on the need for reorganization, revocation of a license or issuing orders to eliminate violations. For carrying out financial stabilization measures, the position of the DIA, whose funds can be allocated for the reorganization procedure, becomes important. If the DIA refuses to provide financing, the most likely decision of the Central Bank of the Russian Federation will be the revocation of the license and the subsequent bankruptcy of the problem bank.

Where else can the sanitization procedure be applied?

The resolution procedure can be applied not only to banks. This measure is provided for enterprises of any type. It entails changes not so much in the material sphere as in the legal one.

A diversified enterprise is subject to a merger with another company with a similar focus. In other cases it is divided into segments. Often an enterprise is privatized or transformed into an OJSC.

ATTENTION!

Resolution is only used in cases where the company can be saved. If the company is hopeless, bankruptcy proceedings are applied to it. This process is controlled by the arbitration court.

The role of the Central Bank and the Deposit Insurance Agency in the process of bank recovery

When carrying out reorganization, the Central Bank and the DIA exercise control at all stages of the procedure. In addition, an important function of the Central Bank is the selection and appointment of a sanator, that is, a large bank that has a stable financial position and has sufficient resources to help a problematic credit structure. The events of recent months have shown that the Bank of Russia did not always make the right decisions, appointing FC Otkritie as the sanator of Bank Trust in 2014 (at the same time, the DIA allocated 157 billion rubles), and Binbank in the same 2014 as the sanator of the banks of the Rost and Bank Credit systems. As a result, problematic financial structures were saved from bankruptcy, however, serious difficulties began for the banks themselves that carried out the reorganization.

Expert analysis

In order to make a final decision on pre-trial rehabilitation, it is necessary to thoroughly check the financial condition of the debtor. This happens in order to come to economically correct conclusions about the possibilities of restoring the solvency of the enterprise within a certain period of time without initiating bankruptcy proceedings with an appeal to the arbitration court.

The expert analysis is carried out by a group of representatives of independent auditing or consulting firms. By-laws and instructional materials regulate current liquidity ratios, securing current assets using own funds, and restoring the ability to pay payments.

As practice shows, the indicators that were adopted as criteria cannot fully reflect the current financial condition of the company, because they depend on what industry the enterprise belongs to. The experience of implementing such practices indicates that the standard values of some indicators can be determined by looking at the industry of the debtor company. This data is used to analyze the situation, and not to make a decision regarding reorganization.

As a rule, reorganization is carried out based on the capabilities of one of the following external sources:

- Merger of a company with another, more powerful enterprise.

- Issuing new securities to raise money capital.

- Increasing bank credit and receiving subsidies.

- Reducing the payment on a bond and deferring its repayment.

- Full or partial purchase by the state of shares owned by an enterprise.

In addition, financial rehabilitation can also be carried out by attracting funds from the owners of the company, the largest creditors or personnel working at the enterprise.

Pros and cons of reorganization for the investor

For a depositor of a troubled bank, successful resolution can be extremely important. This is explained by the fact that with an alternative option, that is, a bankruptcy procedure, there is a high probability that a significant part of the bank’s clients simply will not be able to receive the invested funds in full. Typically, this development of events is associated with a lack of bank assets to pay off all its accumulated debts.

Bank depositors who are individuals can count on a guaranteed receipt of funds in an amount not exceeding 1.4 million rubles, including accrued interest. The chance of receiving anything more than the specified amount during bankruptcy proceedings is quite small. Moreover, it usually extends over a long period, while payment from DIA funds is made within 2 weeks after the start of bankruptcy or liquidation of the bank.

Considering the above, it becomes clear why successful reorganization is extremely important for investors, especially large ones. In this case, their relationship with the bank will continue on the same terms, which will allow them to save and even increase funds on deposits.

Feasibility of treatment

Performing sanitation is important for maintaining healthy teeth throughout life. The need for such procedures is relevant at any age and will allow you to forget about toothache for a long time. Our doctors will explain the importance of all procedures to restore oral health and provide the necessary treatment. Professional sanitation of the oral cavity performed in our clinic will be the key to healthy teeth and provide a delightful smile.

This article is for informational purposes only, please consult your doctor for details!

Measures to prevent bank bankruptcy

When the first signs of financial problems appear, the bank’s management has the opportunity to independently take measures that will avoid not only bankruptcy, but also the introduction of a reorganization procedure. There are many different options for solving problems that arise:

- receiving financial assistance from the owners of a credit institution or their partners;

- development and implementation of a cost optimization program;

- changing the structure of the bank's assets and liabilities to bring them into compliance with the requirements of regulatory authorities;

- issue of bank shares in order to obtain additional financing, etc.

Practical measures to prevent bankruptcy can include any actions taken by the management of a problem bank, aimed at improving its financial condition and increasing operational efficiency.

Rehabilitation methods and requirements for the debtor company

Reorganization of enterprises is a financial and economic procedure that helps improve the condition of the company and prevent bankruptcy. There are several main methods of sanitation:

- the amount of share capital is reduced (decreased) by reducing the number of issued shares or exchanging shares for a large part of old shares;

- government subsidies, preferential loans, tax benefits are provided;

- the enterprise is being nationalized;

- antitrust laws are used, etc.

It should be noted that the debtor enterprise must:

- Prevent unproductive spending.

- Comply with creditor requirements as much as possible.

- Comply with the financial reorganization (rehabilitation mechanism) from the list of companies that have real potential for successful economic and financial activities in the future.

What funds are used to finance it?

Rehabilitation can occur at the expense of the following structures:

- Deposit insurance agencies. In this case, financing is provided from a fund formed by compulsory insurance of bank deposits;

- Central Bank of Russia. He can allocate funds both independently and when applying for a DIA in the form of a loan for a period of up to five years, issued without collateral;

- investors found by the Central Bank and DIA. Typically, the investor is a sanatorium appointed by the Bank of Russia, although funds from other commercial organizations can also be attracted.

How long does it last

There are no clear deadlines. Rehabilitation is a long process that can take 1-2 years or longer. The bank is gradually getting out of the financial hole, which takes time. There are examples when a bank was reorganized within 10 years. It all depends on how quickly the organization pays off the funds received.

It is difficult to say in advance how long it will take for financial recovery. It all depends on what position the bank is in. In some cases, rehabilitation is carried out faster, in others it takes a longer period.